A case study of Corona Extra beer

by Andreas Bayerl, Maximilian Beichert, Christina Schamp, Stefan Kluge

The spread of the SARS-CoV-2 virus, known by the vast majority as Coronavirus, seems to be one of the greatest pandemics modern times have seen. In March 2020 more and more countries in Europe face lockdowns in order to isolate the virus and stop spreading it across the world. Severe economic and humanitarian consequences are the main concerns of our society which we might encounter in the near future. At the same time, across the ocean there is a Mexican beer brand called “Corona Extra”.

Consumer research has evaluated from different angles how consumers react to similar stimuli or environmental cues in their shopping behavior. However, so far there are only few examples addressing how a clearly negative associated event like this public health crisis affects consumer behavior.

Against that background, the coincidence of the two names motivated us to look at potential spill-over effects from the media buzz around the virus to (1) Google search volume of Corona beer, (2) follower base growth of the Corona beer brand’s account on social media and (3) actual sales of Corona beer.

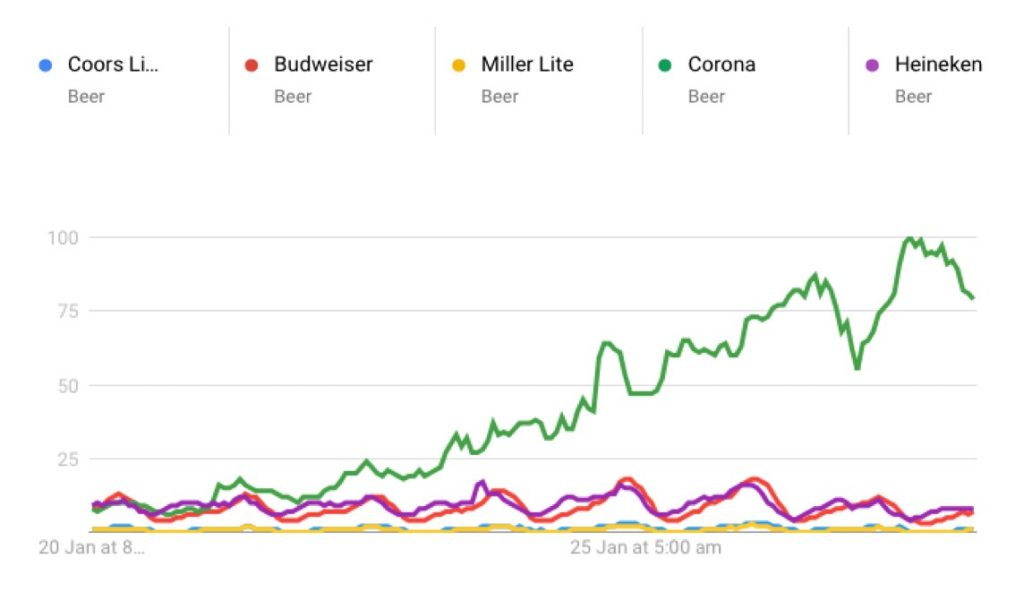

Google Search Volume

In our first blog article (How a beer brand might benefit from a world-wide outbreak of a virus – The Corona Case), we ran a Google-Trend Analysis comparing worldwide Google Search volume for major beer brands in comparison to Corona beer (see Figure 1). To our surprise, we found a strong upward trend for search queries related to Corona beer, while search volume for other American beers stayed at fairly the same level. Before the outbreak, the search terms showed parallel trends.

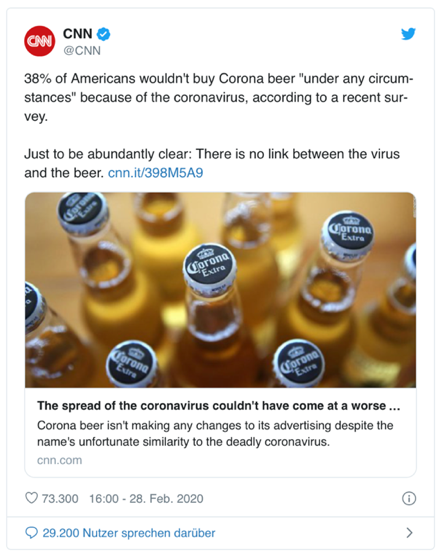

A lot of media articles were cited and recited which stated that because of the Coronavirus Corona Extra beer sales are declining. These articles made it appear that there was a causal link between the virus and Corona beer sales because of the resemblance of their names. For example, CNN, the New York Post, and Vice all shared a survey among 737 participants in the US stating 38% are not considering to buy Corona beer anymore (e.g.: see Figure 2).

However, this result might be taken out of context, as only 4 percent of Americans who regularly drink Corona said they would now stop drinking the beer (5WPR). It may well be that with an increasing number of countries on lockdown less beer will be consumed overall because fewer social gatherings take place. But this will affect the entire beer industry and not just the Corona beer brand. The right analysis here would be to compare a potential decrease of Corona beer sales controlling for the potential decrease of beer consumption across all other brands and for the whole product category.

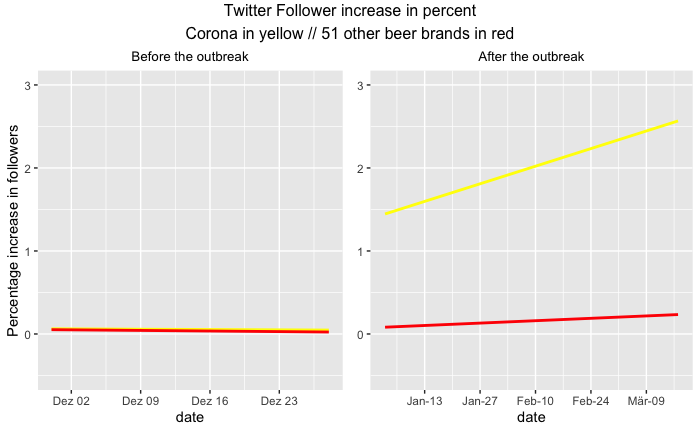

Follower base growth on social media

Contrary to initial claims, one might therefore indeed wonder how a constant reminder of Corona might affect brand recognition and loyalty of the beer brand. Indeed, being constantly exposed to the brand name might be “free advertising”, however it is unclear how the negative connotation is spilling over to the beer brand.

To evaluate the consequences on brand recognition, customer loyalty and brand endorsement for Corona beer, we therefore analyzed the Twitter accounts of more than 50 beer brands before and after the outbreak of the virus. Before the outbreak, Corona beer does not show different patterns in increase of Twitter followers compared to the industry averages; the trends for Corona beer and the average of more than 50 other beer brands are almost parallel. However, consumer reactions appear to change for Corona beer after the pandemic outbreak: While the percentage increase of Twitter followers of the beer industry remained stable and close to zero, we observe growth rates in the number of followers of the Corona beer account of around 2%, moving from week n to week n+1 (see Figure 3).

Actual sales of Corona beer

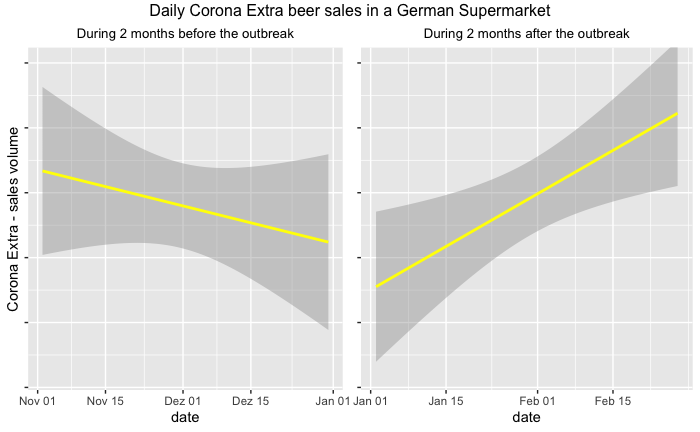

In a further step, we analyzed the sales volume of Corona Extra beer in a German supermarket for a time horizon of two months before and after the outbreak. Similar to the development of the Corona Extra brand on Twitter, we identified a clear increase in sales volume after the outbreak of the virus (see Figure 4).

Even though we cannot control for overall beer consumption, prior year’s sales as well as prices and promotions in this analysis of raw sales volume, our results suggest that Corona might not been affected as negatively at this stage of the crisis as conventional wisdom might suggest.

As a further robustness check, we evaluated the raw sales data of a local beverage wholesaler. Again, the results replicated that Corona beer sales were actually increasing from January to March.

Furthermore, one could argue that a comparison to other beer brands is necessary in order to derive a more robust result.

Setting the Results in Perspective

Marketing research has evaluated how subtle cues and associations in the environment are driving consumer behavior. For instance, Berger and Fitzsimmons (2008) demonstrate that consumers are more likely to buy more orange products around Halloween when orange is a prevalent color in the US environment. Their results show that products are more accessible, evaluated more favorably, and chosen more frequently when the surrounding environment contains more perceptually or conceptually related cues. As such, if consumers stand in front of the supermarket shelf, Corona Extra beer might become more accessible than other beer brands and easier to process. What is striking about our results, however, is that this effect seems to occur independently from the sentiment of the association. Clearly, Corona should transport negative associations that, however, seem not to hinder purchases. This phenomenon has not been studied before.

In addition, likely as coping mechanism to the potential crisis, consumers might also make deliberate “fun” purchases of Corona Extra beer. This explanation might be corroborated by an increase of “ironic” and “funny” social media pictures posted that link Corona Extra beer to the current health crisis.

Limitations

We caution that our analysis only reflects one point in time, with sales data ranging from January to March. “Fun” purchases or the positive spillover of negative associations might be only a short-term phenomenon that might fade out after the introduced measures to fight the public health crisis. Follow-up analyses are therefore needed to set these results in perspective.

In addition, our results shed the spotlight only on one case example, illustrating how consumers might behave in unpredictable ways and how brands might have short-term success against negative associated environmental cues. Further examples are needed to evaluate these phenomena on a broader scale – we are grateful for your comments and ideas if you have further examples in mind!