Sarah Steinhauser and Ülfet Isci-Özalp

Pandemic lasted over two years and has had significant social, economic, and political implications. Since the WHO officially declared the Corona Virus Disease a pandemic on March 11, 2020, a second, third and fourth wave along with new variants have forced governments to impose unprecedented and increasingly tight restrictions on population and economy to prevent a further spread of the virus (Yazdanparast and Alhenawi, 2022). These restrictions forcibly changed people’s lifestyle and as a result the way of doing business. Social distancing restrictions and temporary curfews have made physical interactions with customer seldom or not at all possible. Businesses had to rethink their way of offering products, new models of servitization became central, and the way of communicating and managing customer relationships had to be changed (Di Maria et al. 2021).

Consumers have changed the way they engage on social media, their unplanned and planned purchasing habits, what schemata they use to decide, how they make use of retailer services, their traveling purposes and much more. With the pandemic acting as an exogenous influence and life-changing event, there has been a shift in what the consumer perceives to be essential. To be able to adapt to the new situation and satisfy customers’ new needs and preferences, managers and marketers will have to understand the transformation consumer behavior has gone through (Di Maria et al. 2021).

An avatar has been created in the literature to describe new consumer habits (Sorrentino et al. 2022). The following profile is based on this avatar the new consumer is digital, responsible, home centered, self-care oriented and health oriented (see Figure 1). These characteristics are often correlated and influence each other.

Digital

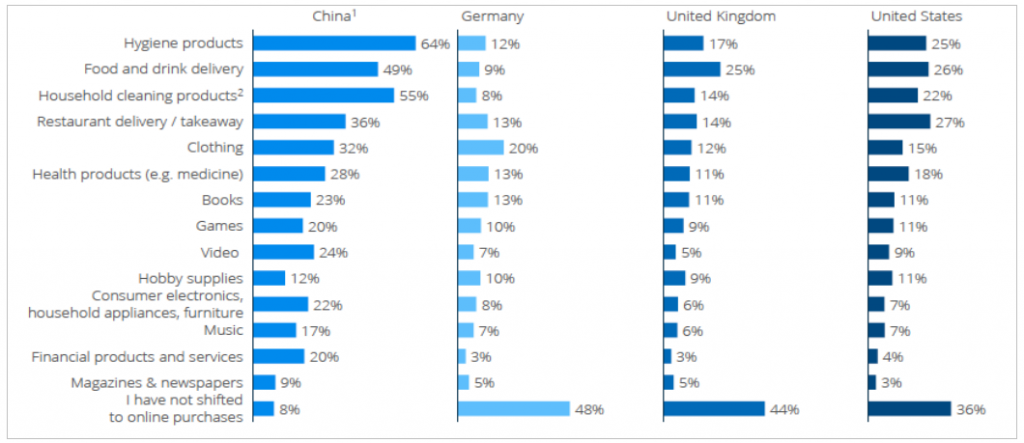

The COVID-19 pandemic coincides with an already rapid advance of digitalization and has further accelerated this trend. Many people previously naïve to the internet and online shopping have now developed the habit of purchasing on the internet. Figure 2 shows that most Chinese consumers shifted from offline to online purchases in comparision to other selected countries during the pandemic.

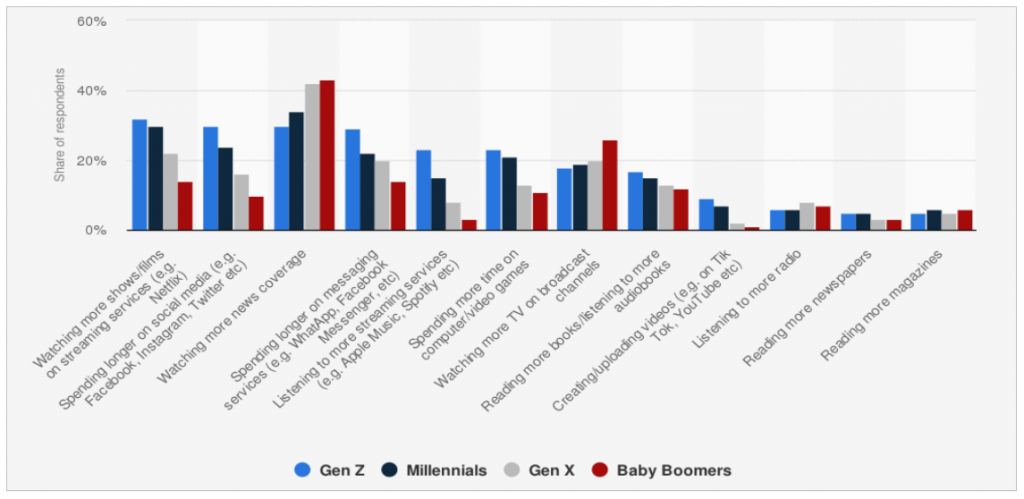

Additionally, this pandemic has had a direct impact on media consumption on a global level. Data varies country by country, but figure 3 on increased media consumption among four different generations also reveals certain patterns. For example, Gen Z are 20 percent more likely than Boomers to have spent more time listening to music streaming services, whilst Gen X are the most likely to have been listening to the radio more as a result of the COVID-19 pandemic. Traditional formats were less prefereable to social networks or messaging apps, with newspaper and magazine readership increasing by just three to six percent across all generations.

Responsible

In the pandemic people show heightened interest and concern for the broader ecological and social system as they care increasingly for societal and environmental behavior. This is confirmed by an observed increase in trust in green brands (Cruz-Cárdenas, 2021). Additionally, reuse practices have been gaining popularity as they result in saving manufacturing resources and energy (Huang and Fishbach, 2021). Consciously buying local to support retailers and restaurants also shows a desire of taking responsibility for others. Moreover, a deeper consideration of what to purchase and what is essential has been observed (Mehta et al. 2020).

Home centered

Lockdowns and quarantines have forced people to spend more time at home than they did previously. Activities that had previously occurred outside were now moved into houses and apartments (Sheth, 2020). Homes were transitioned into working offices, gyms, classrooms and so forth and have therefore greatly expanded their purpose (Kirk and Rifkin, 2020) Additionally, leisure time activities have also been moved to home. Streaming platforms have increased in popularity with Netflix gaining over 16 million subscribers between April and June 2020 (Hoekstra and Leeflang, 2020).

Self-care oriented

The increased flexibility and time availability while working from home has resulted in people focusing on themselves, their creativity and the discovery of new talents. (Sheth, 2020). Consumers report that more time is spend being creative and finding entertainment at home by cooking, gardening, baking, and doing game nights.

People also use the time to renovate their homes. This can be seen in a significant increase in sales of home improvement retailers (Kirk and Rifkin, 2020), as well as in the 25% rise in sale of ‘do-it-yourself’-products (Hoekstra and Leeflang, 2020).

Health-oriented

Health and hygiene regulations have become the new standard to prevent further spread of the virus. Moreover, the trend of choosing healthier food options and taking better care of the own body has also been accelerated by the pandemic (Boyle et al. 2021).

These new characteristics in a behavioral consumer profile will be important for understanding consumer behavior during and post-pandemic. Furthermore, it comes into question that how these new characteristics and preferences manifest themselves in specific sector. This recent pandemic has had significant implications for industries like healthcare, hospitality, tourism and travel, retail, and education (Das et al. 2021).

Changes in financial decisions, spending, and saving behavior.

The pandemic has had severe consequences for people’s income and household financials. The economic downturn caused by the pandemic has resulted in many job losses. This has significantly

reduced consumer spending (Roggeveen and Sethuraman, 2020). For example, in the United States – amongst the countries with the highest number of cases – almost 25% of the population have been affected by unemployment (Hoekstra and Leeflang, 2020). In Italy, also among the countries that has been hit severely, consumption has been returned to its state in the 1980s (Sorrentinoet al. 2022).

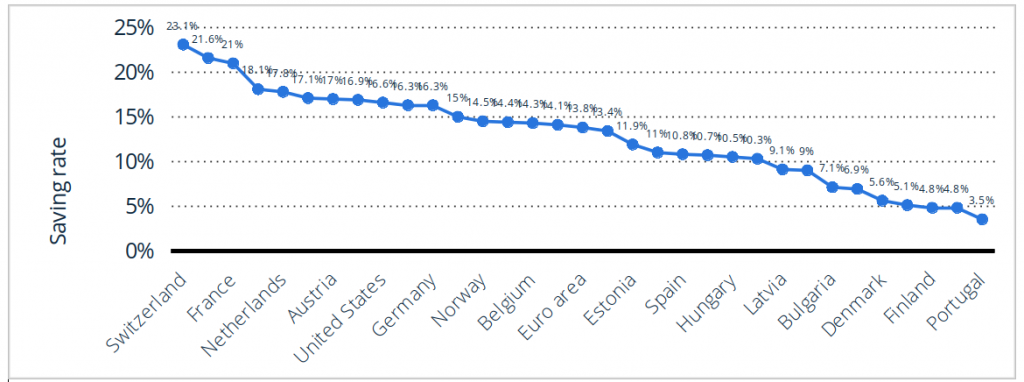

Job losses and closure of businesses have led to financial scarcity (Das et al. 2021). As a result, many consumers have chosen to defer purchases of non-essential goods to a later time which can lead to pent-up demand (Mehta et al. 2020). With some exceptions, the household saving rate during the COVID-19 pandemic was quite high in most of the countries considered. As of 2020, the household savings rate in Switzerland was the highest among the selected countries (23.1%). Ireland followed in the list, with a saving rate of 21.6%. (see Figure 4)

OECD Economic Outlook, Volume 2021 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/66c5ac2c-en

Changes in grocery shopping behavior: panic buying and new preferences for grocery shopping.

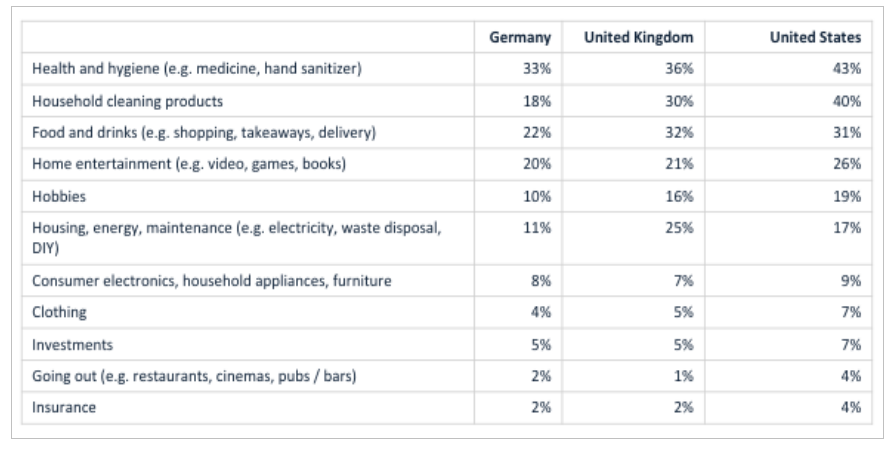

While retailers of non-essential goods, such as footwear and apparel, had to account for a significant decrease in sales and revenue, retailers selling essential goods, such as groceries, have been experiencing continuing demand. Still, these retailers have been faced with challenges as they have tried to manage supply chains, inventory and delivery problems in regards of a sudden rise in panic buying (Roggeveen and Sethuraman, 2020,). According to the Statista’s survey (2020), due to the coronavirus pandemic, health and hygiene products lie at the top of the shopping list among consumers aged 18 and older in the U.S. Medicines, hand sanitizers and toilet papers are flying off the shelves as consumers are spending way more than usual on these types of products. Other popular items include household cleaning, food & drinks and home entertainment products. Figure 5 illustrates that products and services people spend more than usual on products and services in the United States, United Kingdom and Germany in 2020 due to the COVID-19 pandemic.

Although restrictions due to the pandemic have become less strict in most countries, a significant proportion of consumers tends to avoid brick and mortar stores. According to a survey from February 2021, respondents having the habit of specifically avoiding public interactions and/or adhering to social distancing guidelines were 48 percent in Great Britain, and 44 percent in Denmark. French consumers appeared to be the least concerned, with just 25 percent of respondents still avoiding physical stores due to the pandemic. (see Figure 6)

New grocery shopping behavior also confirms the consumer as being increasingly digital. To avoid contagion in stores, many have started to use grocery delivery services (Chenarides et al. 2020) This development has been facilitated by an increased use of digital payment and online payment (Roggeveen and Sethumaran, 2020.).

Changes in traveling behavior: new preferences for restaurants, hotels, and tourist destinations.

COVID-19 was an extreme market disruption in the hospitality and tourism industry, greatly affecting restaurants, hotels, and travel destinations. In the United States, the restaurant industry had to account for a sales loss of 185bn$ in the beginning of the pandemic. 40% of all restaurants had to close and restaurant visits declined by 90% (Kim et al. 2021). In April 2020, flights in Europe declined by 85% and flights in the United States by 95% (Das et al. 2021).

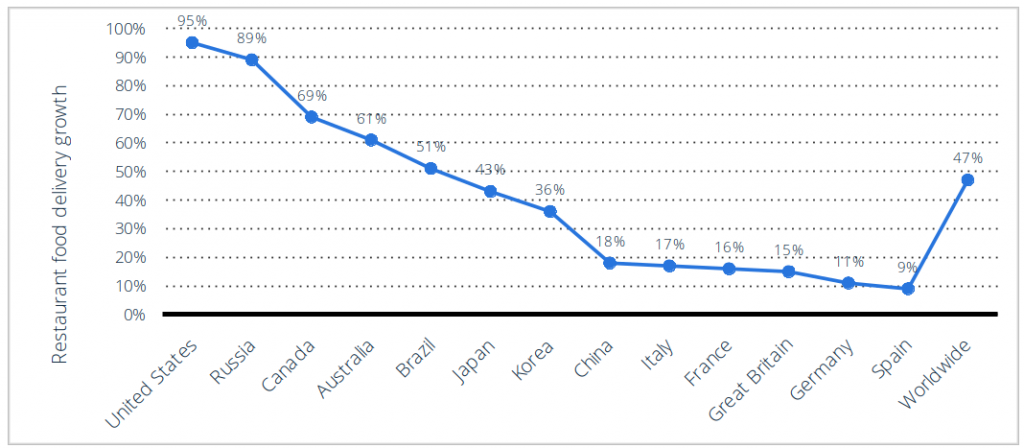

Between 2019 and 2020, the coronavirus (COVID-19) pandemic lead to unprecedented growth in off-premise food services. Overall, food delivery at restaurants worldwide increased 47%, with the US, Russia and Canada growing 95%, 89% and 69%, respectively. (see Figure 7)

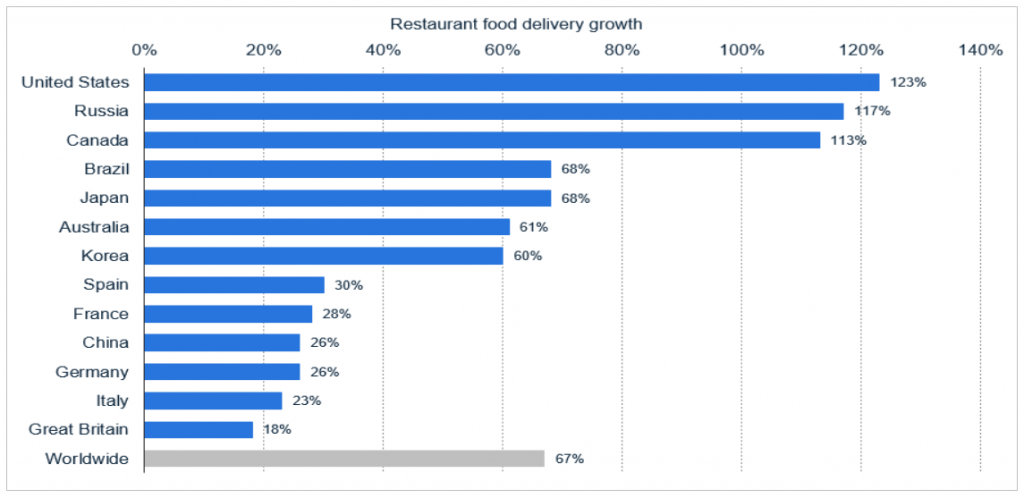

Additionally, consumer demand was so high that many restaurants planned to collaborate with online meal delivery applications (Zhao and Bacao, 2020). Figure 8 illustrates that global digital restaurant delivery grew 67% overall, with the United States growing the fastest at 123%

Concerning the travel behavior, many people have postponed vacations due to financial reasons (Del Chiappa et al. 2021). Of those who did choose to travel, the majority did so within national borders. Moreover, consumers focued on safety and health. In fact most participants favored private cars over public transport, especially for shorter distances. More consumers have paid for travel insurance and there is high interest in protective equipment like hand sanitizer and face masks. An important development concerning the digitalization of the industry is virtual reality. Various activities using VR have created the possibility to experience an illusion of traveling while safely staying at home or in-doors.

Will Behavioral Changes Be Temporary or Permanent?

These behavioral changes concern financial decisions, and new food consumption habits as well as new traveling preferences but of course they concern many more industry sectors. This new consumer behavior is likely to have an impact on how the consumer will search for, purchase, use and dispose of products and services in a post-pandemic future.

People perceive the risk preventative behavior recommended by the government, such as social distancing and mask wearing, as effective and feasible (Kim et al. 2021). Customer will therefore be more likely to accept and more importantly expect heightened health and hygiene standards in the future. This will be especially relevant in the hospitality and the retail industry (Del Chiappa et al 2021).

Many consumers have adopted the habit of buying fresh ingredients like vegetables and fruit (Boyle et al. 2020) Furthermore, they have acquired digital skills or used them for activities where they have previously not relied on technology. This includes streaming services, online food and grocery delivery, working from home, and social or professional interactions via web conferencing platforms. They are also likely to continue in the future.

Many agencies and firms were forced established the necessary hard- and software to be able to do business with these consumers in a time of physical distancing. This has paved the road for increased e-commerce as well as an increased use of the internet for government and agency-related topics. This concerns for example the medical sector, where the possibility and growing popularity of transferring medical diagnoses online facilitates a future change in business processes (Zwanka and Buff, 2021). Consumers have gotten accustomed to a hybrid environment as a mix of online and offline events and are likely to continue using its benefits.

Generally, many habits consumers have formed during the pandemic might stay if they prove to be more convenient than previous ones. For example; working and schooling from home was perceived as convenient and well liked. Online-shopping and cooking were named as well. However, given leisure time activities, consumers have indicated that they are looking forward to going back to pre-Covid conditions. This includes dining out and going to concerts (Sorrentino et al. 2022). Still, the increase in home entertainment and streaming platform subscriptions indicates that consumers might also appreciate the convenience of watching movies and TV-shows from home instead of theatres (Hoekstra and Leeflang, 2020).

From the managerial perspective, customers expect brands to show awareness and understanding of the impact of COVID-19 and offer their products as support in dealing with the current challenges (Kirk and Rifkin, 2020). Research has shown that proactive emails containing personalized ideas and recommendations for adjusting to current situation have been appreciated and strengthened customer bonding. Demonstrating Corporate Social Responsibility has improved customer attitude and heighten purchase intentions. If possible, a firm should also emphasize the sustainability of its brand to address the consumers’ increasing environmental concerns

With the customer being increasingly digital, firms must be aware that clients may have developed new customer journeys and different touchpoints in their interactions with companies. People have gotten used to higher online engagement which means that managing online presence has become even more important. (Hoekstra and Leeflang, 2020). Pushing e-commerce will also facilitate reaching customers who have developed the habit of spending an increasing amount of time at home. Consequentially, it is vital for companies who already have an online presence, to renew their focus on e-commerce, while those who have previously not engaged in any business online are recommended to do so.

Firms with a higher degree of flexibility show better performance in times of environmental uncertainty (Hoekstra and Leeflang, 2020; Sheth, 2020). Firms which successfully adjusted to the pandemic have rethought their offerings and adjusted their manufacturing and business processes. For example; Ford Motor Company and GE Healthcare have collaborated in transforming their production facilities to produce ventilators. Some distilleries have switched to producing hand sanitizer (Das et al. 2021). Target al Walmart have started to offer online grocery shopping (Sheth, 2020). Businesses will have to learn to increase their flexibility. This will make their processes, infrastructure, and systems more resilient in times of uncertainty and economic downturn.