by Marcia Werner and Andreas Hamann

After having dealt with several political, economic, and health incidents in the last decade, the world economy is now struggling with the consequences of the highest inflation rate in over 20 years. Consumers are confronted with increasing prices for daily goods, which forces them to rethink and change their previous purchasing behaviour. The new needs, desires, and spending patterns of customers as well as higher prices for upstream products create major challenges for companies to meet the changing demand. Yet, there is no clear guide for marketing managers on how to adapt their businesses in difficult economic times. Therefore, this article examines changes in consumer shopping behaviour in the context of past economic crises. Based on this, possible marketing strategies are outlined to cope with the changing demand in such times.

Inflation in 2022

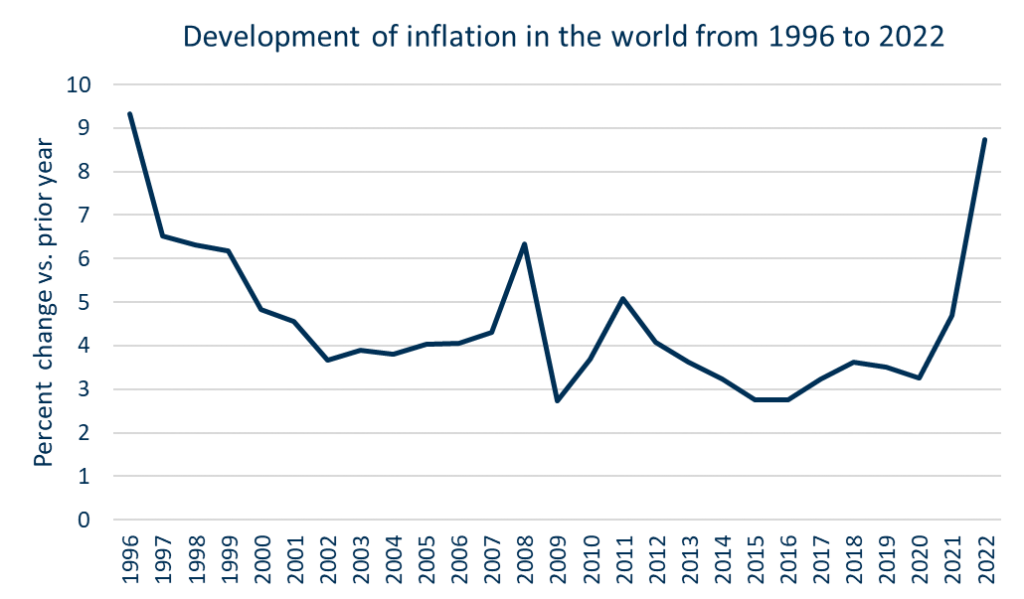

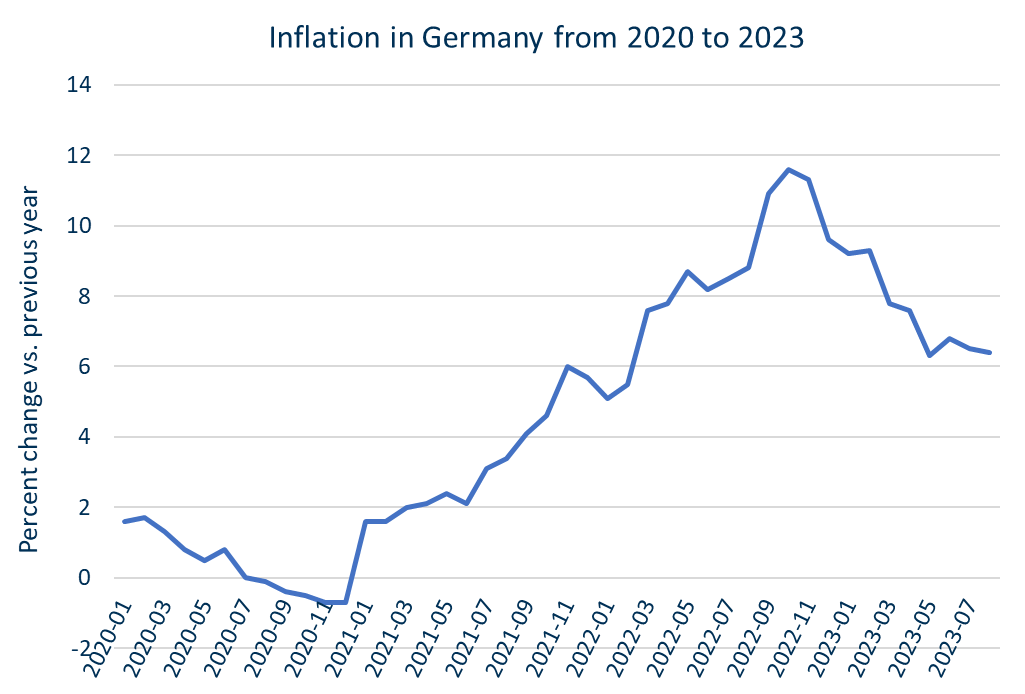

The increase in the general price level already started during the Corona pandemic. The national safeguard measures led to a collapse of global supply chains, which caused prices for raw materials and intermediate products to rise sharply. The outbreak of the Ukraine war in 2022 fostered this development. It triggered a severe energy crisis in Europe and caused prices of energy products, cereals, and plant oils to increase significantly. On average, the price level in the world increased by 8.7% in 2022 compared to the previous year. A similar figure was reached in Germany, with inflation even exceeding the 10%-mark in some months, representing the highest rise since the oil crises. As the price increases are not accompanied by rising household incomes, consumers’ purchasing power declines. With less disposable income, consumption options become more limited. Apart from that direct financial effect, economic crises also affect consumers indirectly due to psychological factors. The uncertainty and fear of the future that an economic crisis entails, creates feelings of panic and reduces the trust that risk-averse consumers have in companies and institutions. This stimulates changes in consumer’s purchase patterns to be able to cope with the economic crisis.

Changes in Consumer Buying Behaviour

Consumers can change their behaviours in different ways and not every person will be affected by a crisis in the same way. In particular, highly risk-averse consumers, who are most often characterized by low income and are thus most affected by sharply rising prices, show the largest adjustments in purchasing behaviour. On the contrary, consumers in a financially stable situation who are expected to have higher confidence and be less risk-averse, mostly maintain their spending habits with only minor adjustments. However, a total of five major purchase pattern modifications could be identified, which are enforced to varying degrees by all consumers.

In the wake of a high inflation rate, consumers appear to reduce their consumption expenditures not only in the year of the crisis but for up to three years thereafter. The analysis of former crises reveals that the cut-back in spending exceeds the decline in disposable income. Being confronted with rising uncertainty, risk-averse consumers precautionary allocate parts of their income to savings. However, the reduction in spending is not the same for all types of goods. A smaller share of monetary resources is spent on durable goods with income elastic demand, while a larger share is allocated to the purchase of non-durables and essential services. Engel´s law acknowledges that consumers rather purchase necessities like food staples and public transportation and reduce the expenditures on discretionary goods like clothing, entertainment equipment, and airfare when they have less income at their disposal. Some products or services might even be completely dispensed temporarily. In contrast to these findings, vicious luxuries such as beer, cigarettes, and gambling experienced increasing demand during some crises. The consumption of these luxuries can act as an escape mechanism that helps people flee the stress and difficult reality for a short time.

In addition to the shift in budget allocation, consumers change their brand preferences for essential goods in times of high inflation. The shortage of disposable income causes consumers to become more price-conscious and focus on paying low prices. Therefore, consumers give up their preferred brands to buy similar but lower-priced substitutes. They gradually switch from premium brands to challenger brands to eventually consume private-label products. These products are owned and marketed by a retailer and exhibit nearly similar quality levels as branded products at a lower price. The switch to private label products in times of crisis mainly occurs in product categories with a low risk of making a wrong purchase. Therefore, product categories such as food and cleaning products tend to experience an increase in private label consumption rather than medical or personal hygiene products. As consumers’ perceptions and attitudes towards private labels are changed, the brand switch can last beyond the crisis.

In line with declining brand loyalty, consumers are more willing to change their preferred shopping stores in times of crisis. They increasingly rely on wholesale outlets and discounters as these retailers offer a wide range of private-label products and overall low prices. Furthermore, consumers purchase more frequently from online stores. The wide product range offered along with low prices and delivery costs appeals to the more price-conscious consumers during times of economic difficulty.

Increased attention to prices not only leads consumers to switch brands and retailers but also to purchase more consciously. Consumers were found to look out for special offers, and bargains and make use of price discounts and coupons more often. Nevertheless, consumers do not neglect the quality of a product when making a purchase decision. Value-conscious consumers are looking for the best value for money and are not willing to sacrifice quality for price. This is in line with the observation that consumers prefer lower-priced private-label products of similar quality to branded products. However, the definition of quality changes in the light of a crisis, from fashion and novelty to functionality and durability. Consumers are willing to spend a little more on products with low holding costs that can be used for a long time and are trying to purchase them at the lowest possible price.

The increasing price- and value-consciousness of consumers during economic crises results in consumers making more deliberate and rational purchase decisions. They weigh the advantages and disadvantages of a purchase more thoroughly and spend more time planning a purchase. Consumers are trying to minimize the risk of a wrong purchase and the accompanying financial loss by informing themselves about the prices and benefits of different products. In this context, they make increasing use of online stores which offer a wide variety of information. Related to this is the reduction of impulse purchases. Less disposable income and increased use of shopping lists along with more information searches reduce impulsive spending.

Marketing Strategies

Marketing strategies that were successful during economic prosperity will most likely not be applicable in times of crisis. As consumer needs and desires change, companies must make appropriate adjustments to their marketing mix and develop strategies in line with customers’ expectations.

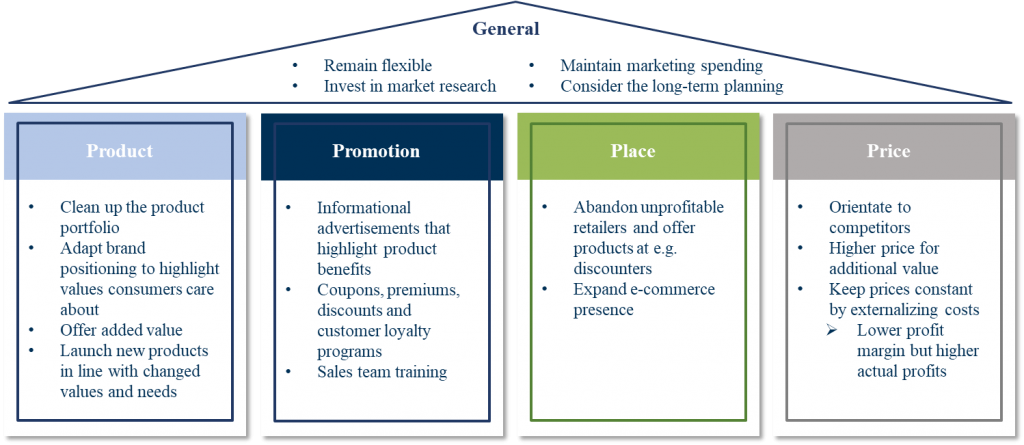

In the context of a crisis, companies often first try to cut all possible costs, with advertising and promotional expenses usually being among the first to be reduced. However, the analysis of past economic crises has shown that contrary to intuition, companies should maintain their marketing expenditures. This allows them to adapt their marketing strategies to the consumers’ needs and gain a competitive advantage, which ultimately results in faster and stronger growth in market share and profits once the crisis is overcome. Companies should therefore not only focus on coping with the current crisis but also keep an eye on the long-term goals and planning of the organisation. To adapt marketing strategies accordingly, companies must first understand exactly what industry-specific adjustments customers are undertaking in their purchasing behaviour. Therefore, it is essential to invest in market research in times of crisis, to identify possible opportunities and threats. Nevertheless, in the end, it is extremely important to remain flexible. Regardless of the course, extent, or duration of a crisis, companies must be able to react quickly and adequately to changes in the economy and demand.

Product Strategy

During a crisis, companies should rethink and review the applicability of their current product management and new product development strategies. Products that do not offer any real added value and are merely another variant of an existing product such as different smells, tastes, and sizes, should be removed from the product portfolio. A more concise portfolio is easier to manage and allows companies to focus their resources on the core products.

It seems tempting to alter the core products’ positioning during a crisis to attract new customers. However, previously loyal customers are lost as a result. Companies should maintain the values a product stands for, yet it is possible to adapt the positioning to appeal to value and price-conscious consumers by emphasizing values such as affordability and austerity. In this context, the analysis of past crises has shown that companies can benefit from offering consumers added value for the price they pay. Repair services or extended warranties of durable goods can counteract the budget shift to non-durable goods and provide consumers with greater value for the same price.

Companies will typically defer new product developments due to rising costs in the wake of high inflation. However, past crises revealed positive effects of new product launches that are aligned with consumers’ new values and needs. Companies can benefit from a first-mover advantage which helps to gain market share and make profits in the course of recovery. Moreover, introducing new products gives consumers confidence in times of great uncertainty and can help to attract new and maintain existing customers. The new products can be introduced as part of fighter lines. These carry the brand’s good name and thereby promise a certain quality, but are significantly cheaper. This prevents consumers from switching to private label products and allows companies to tap into another market and attract new customers.

Promotion Strategy

Since many companies cut back on advertising expenditures during periods of economic uncertainty, companies that choose not to do so, automatically increase their share of advertising voice and their presence in the market. Consumers pay more attention to these advertising campaigns, which increases the overall effectiveness of advertising. When maintaining advertising spending, companies should focus on creating informational rather than transformational advertisements. Informational ads aim to convince the consumer to buy the product by demonstrating its performance and highlighting individual components of the product. This is particularly appealing to value-conscious consumers who are looking for the best value for money and provides consumers with the necessary knowledge they aim for during their information search.

Another important aspect of the promotion strategy is the use of various types of sales promotions to attract price-conscious consumers. Since consumers are more likely to switch brands during an economic crisis, companies can take advantage of this behavioural adjustment. They can utilize coupons, premiums, and discounts to attract customers and persuade them to switch to a company´s products. A way to keep current consumers coming back is through the use of loyalty programs.

Place Strategy

Previous crises revealed that consumers switch retailers more easily and particularly rely on discounters which offer them low prices and private-label products. Companies should therefore examine the success of their current distribution channels and offer their products at retailers that are attractive to customers. Newly introduced fighter brand products for example can be sold at discounters. In general, companies are advised to expand their sales channels which includes the presence in online stores, to support the information search tendency of customers.

Price Strategy

The high rate of inflation is evident to companies in the form of increased costs for energy and upstream products. As profit-maximizing firms try to maintain the profit margin, increased costs are passed to the consumers by raising the prices of the final products. In doing so, prices should not be significantly higher than those of the competition to prevent customer churn. To this end, companies should rely on a cost-plus pricing strategy that calculates the costs incurred during the production process and adds a markup on top.

In addition, companies should increase the value of their products in the course of a price increase. They can optimize the functionality and durability of the products to make them more attractive to value-conscious consumers. Additional services can be offered or small changes to the appearance of the product can be made to give consumers the feeling that they pay a higher price for additional value.

A different pricing approach is to keep prices constant by externalizing costs through the usage of cheaper packaging or materials. Although a company would thereby willingly accept a lower profit margin, it could attract price-conscious consumers, which would result in increased sales and ultimately in a rise in actual profits.

Conclusion and Current Inflation Applicability

The world is currently experiencing the effects of the highest inflation rate in over 20 years. Consumers, directly or indirectly, affected by increasing prices adopt various modifications of their purchase behaviour to cope with such a crisis. They spend less money, shift expenditures from discretionary to necessary goods, pay more attention to prices and quality, and are more willing to change brands and retailers. Companies have a wide variety of marketing mix strategies at hand to react to the changing demand. They are advised to maintain their marketing spending and invest it in new products that offer customers additional value, in advertising campaigns and price promotions to attract new customers and maintain existing ones.

The outlined behavioural adaptations and marketing strategies apply to the current inflation. Due to technological developments, companies have even more possibilities to react. It is recommended to collect real-time data on purchases, transactions, and consumer sentiment to better understand the changes in buying behaviour. Further, machine learning can be applied to pricing to analyse and best exploit consumers’ willingness to pay. The increasing reliance on e-commerce which grew during the covid pandemic, suggests that companies should elaborate an omnichannel shopping strategy that provides customers an optimal shopping experience across both offline and online channels.